BUFFALO, N.Y. (WKBW) — Are you planning ahead for retirement, and do you think you'll have enough saved when the time comes? Many Americans share this concern, especially when everyday expenses make it challenging to think about the future. However, local financial planners say small changes today can significantly impact your long-term financial security.

"We're seeing people be generally unprepared for retirement, and there are a lot of factors that go into that," explained Sarah Blankenship, a Certified Financial Planner with Wilcox Financial Group.

Some of those factors include taking breaks from the workforce, caring for aging parents, or simply thinking you'll get to saving "someday" — but someday comes faster than you realize.

How Much Should I Save?

Generally, experts recommend saving approximately 10 to 15% of your income each year for retirement. That might not always be possible, but it's a good rule of thumb.

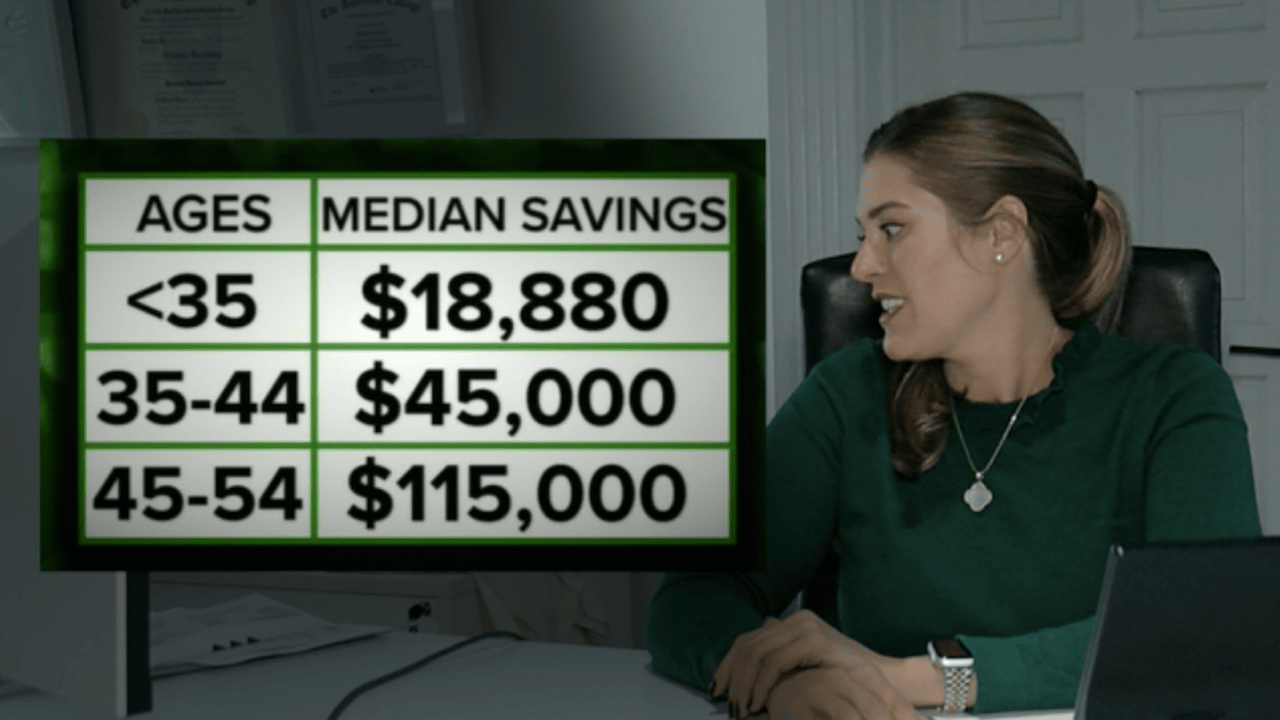

Data from the Federal Reserve reveals the median retirement savings across different age groups. People under 35 have saved about $19,000 for retirement, while those aged 35 to 44 have approximately $45,000 saved. By age 65, the median amount saved reaches about $185,000, including money in retirement accounts like 401(k)s and IRAs. You can take a closer look at the data here.

WATCH: Will you be ready for retirement? Advice for different ages

Financial experts emphasize that the key is simply getting started, and the earlier you begin, the better your outcomes will be.

However, Sarah Blankenship says she's seeing younger people saving less and spending more, and believes social media plays a significant role in this trend. She explained that many of us are comparing our lives to people we might not even know online, which didn't happen in past decades - because the only real comparisons people had years ago were the people living around them.

"You looked down the street — hey my neighbor has 2 cars, I have 2 cars. Our houses all kind of looked the same. People felt good," Blankenship said.

"Today with social media, we feel like we're a giant failure unless we're traveling to Bali or we're wearing the latest designer clothing. Everyone putting their Instagram best foot out there, but no one is seeing the struggle, the credit card bills that might be behind that."

Despite these social media pressures, Blankenship offers specific advice for different age groups to help people get on track with their retirement savings.

Financial advice for your 20s

"I think getting started with a budget is super important, and getting started with some sort of retirement account. Even if it's just a small Roth IRA," Blankenship said.

"Getting used to the idea of not spending every dollar you make and setting some aside later for your goals, for something down the pipeline."

Blankenship explained that starting to save in your 20s helps build important financial concepts and habits that benefit you throughout your life.

Financial advice for your 30s

For people in their 30s, Blankenship recommends expanding beyond basic savings to include comprehensive financial protection.

"In your 30s I would definitely start making sure that you're taking advantage of risk management. Looking at insurances, getting estate documents done, they get more expensive as you get older," Blankenship said.

"That's the time people are buying houses, starting families. Making sure you're adding in that protection."

Financial advice for your 40s

By your 40s, Blankenship suggests taking an even more strategic approach to financial planning.

"In your 40s I think if you haven't — doing an actual financial plan can be really important. That can help sharpen the pencil on what you're doing," Blankenship said.

"Are your investments in-line with the rest of your strategy, pinpointing your goals the next 10, 20, 30 years."

While experts recommend these savings strategies, many young people face different financial realities and spending priorities that can make retirement planning challenging.

This story was reported on-air by a journalist and has been converted to this platform with the assistance of AI. Our editorial team verifies all reporting on all platforms for fairness and accuracy.